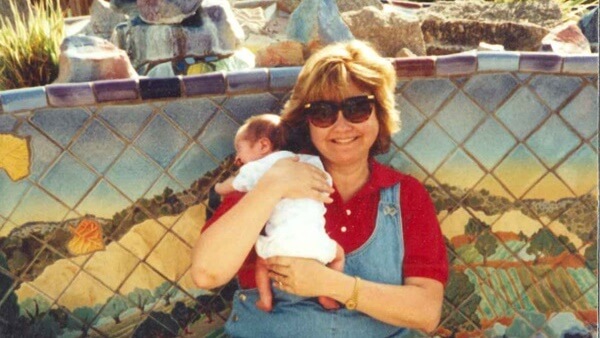

The Adoption Journey for Shannon and Jaxon

I tell people all the time about my adoption journey and that I would have waited forever for my sweet Jaxon. He is worth every second that we waited.

Speak with one of our adoption counselors.

Call or text the Pregnancy Hotline 24/7

Get guidance on opportunities & next steps.

Our office is open in Raleigh, NC.

© 2026 A Child's Hope. All Rights Reserved.

Please select the first day of your last period

Your last period date: